Legacy Giving is the best way to ensure your future and the future of RBARI.

As you know, RBARI does not just aid animals, but provides support to our entire community, assisting in animal welfare emergencies and working with partner organizations to provide low-cost spay/neuter surgeries for communities in need.

EIN: 226-094-179

Bequest from Your Will

By making the choice to include RBARI in your will or trust you are committing to ensuring that RBARI can be here for years to come, and that we will be able to provide shelter, critical care, and a second chance to animals who need it most. So many of the lives we save depend on the generosity and forethought of compassionate individuals, who want to make a lasting impact on animal welfare, through a gift left to RBARI in their Will or trust.

Ways You Can Give Through a Will or Trust:

- Leave a specific dollar amount or asset to RBARI.

- Designate a percentage of your estate to be given through your Will or living trust.

- Charitable Remainder Trust- give only the remainder, or residual of your estate, or that which remains after bequests to loved ones have been made.

The following is an example of suggested language to include in your Will/trust:

"I give and bequeath to Ramapo-Bergen Animal Refuge, Inc., a not-for-profit corporation, with principal offices presently located at 2 Shelter Lane Oakland, NJ 07436, the sum of , or _______% of my estate, to be used for the accomplishment of its general purpose (or for a specific purpose as indicated)".

Ways You Can Give Through Other Means:

- An outright gift of cash

- Securities

- Personal property

- Real estate (real estate is accepted on a case-by-case basis with minimum valuation considerations and a written appraisal)

You may designate your bequest in two ways:

- For the general purposes of RBARI (an unrestricted bequest)

- To be used to support a particular program (a restricted bequest)

There's also FreeWill: a free online resource that guides you through making or updating your will in just 20 minutes, while creating a legacy helping homeless animals in our community. Get started today.

Have you already made a gift to RBARI in your plans?

All you have to do now is fill out this form so we can say thank you and keep our records up-to-date!

Non-Probate Assets

Non-probate assets such as an IRA, 401(k), or life-insurance policy are not covered in your will and you must plan your beneficiaries for them separately. You can designate RBARI as a beneficiary of these assets to provide safe refuge for homeless dogs and cats in our community—at no cost today. You can use this free online tool to receive step by step detailed instructions to get started.

Retirement Assets

Retirement assets are an innovative and beneficial way that you can give to RBARI. What makes retirement assets advantageous? These funds grow tax-free until the time of withdrawal, and with planned use of these assets, you are able to contribute generously to RBARI as well as provide for your loved ones. Consider donating to RBARI via a qualified “Charitable” distribution. Do not take the Required Distribution in a personal account but instead, have it given directly to RBARI. This then qualifies the distribution and the RMD does not become taxable income.

Here are some approaches to consider:

- Outright gift through beneficiary designation. You can name RBARI as the beneficiary or contingent beneficiary of your retirement assets after your lifetime. When a retirement account is left to a charity, the organization does not pay any income tax whereas your heirs may pay income tax if they inherit your retirement funds. Your retirement plan’s administrator can provide a beneficiary form for you to name RBARI as your sole, partial, or contingent beneficiary.

- Charitable remainder trust after a donor's lifetime. You can name a trust as the ultimate beneficiary of excess or unused retirement assets. After your lifetime, the trust can provide income to heirs for a period of years, after which time the trust monies can fund charitable endeavors.

Life Insurance

There are several ways you can help to ensure RBARI’s future though Life Insurance giving.

Here are some suggestions:

- Add RBARI as a beneficiary to your policy. You can usually make a change to the beneficiary of your insurance policy without changing your will or other aspects of your estate plan. Just ask your insurance company for a form that will allow you to make RBARI a beneficiary of your insurance policy.

- Transfer ownership of a paid-up policy. You can transfer ownership of a paid-up life insurance policy to RBARI. After the transfer, RBARI can elect to either cash in the policy right away or keep the policy and receive the death benefit later. You would receive an immediate income tax deduction for either the cash surrender value or the basis (usually the cost), whichever is less.

- Making RBARI the owner and beneficiary. You can make RBARI the owner and beneficiary of a policy that you take out. Premium payments can be made by you directly to the insurance company, and you can take payments as an income tax deduction.

Donating Stocks and Other Matured Securities

By donating matured securities like stocks, bonds, and mutual funds you may be able to increase your gift, and your tax deduction.

- Consider donating highly appreciated stock. Many donors have accumulated and held stock for many years that have appreciated greatly and have become cost prohibitive to sell because of the tax liability. Giving those holdings to the RBARI enables the donor to give the stock at the current market value as a tax deduction without realizing the capital gain.

How It Works

When you donate stock, or another matured security, the full market value of the matured security is given to RBARI, and you’ll likely take a tax deduction for the full fair market value as well. Thereby, increasing the value of your gift, and lowering your tax exposure. Your financial advisor can help you consider the best assets to donate, and the most efficient way to benefit RBARI while also reducing your own tax liability.

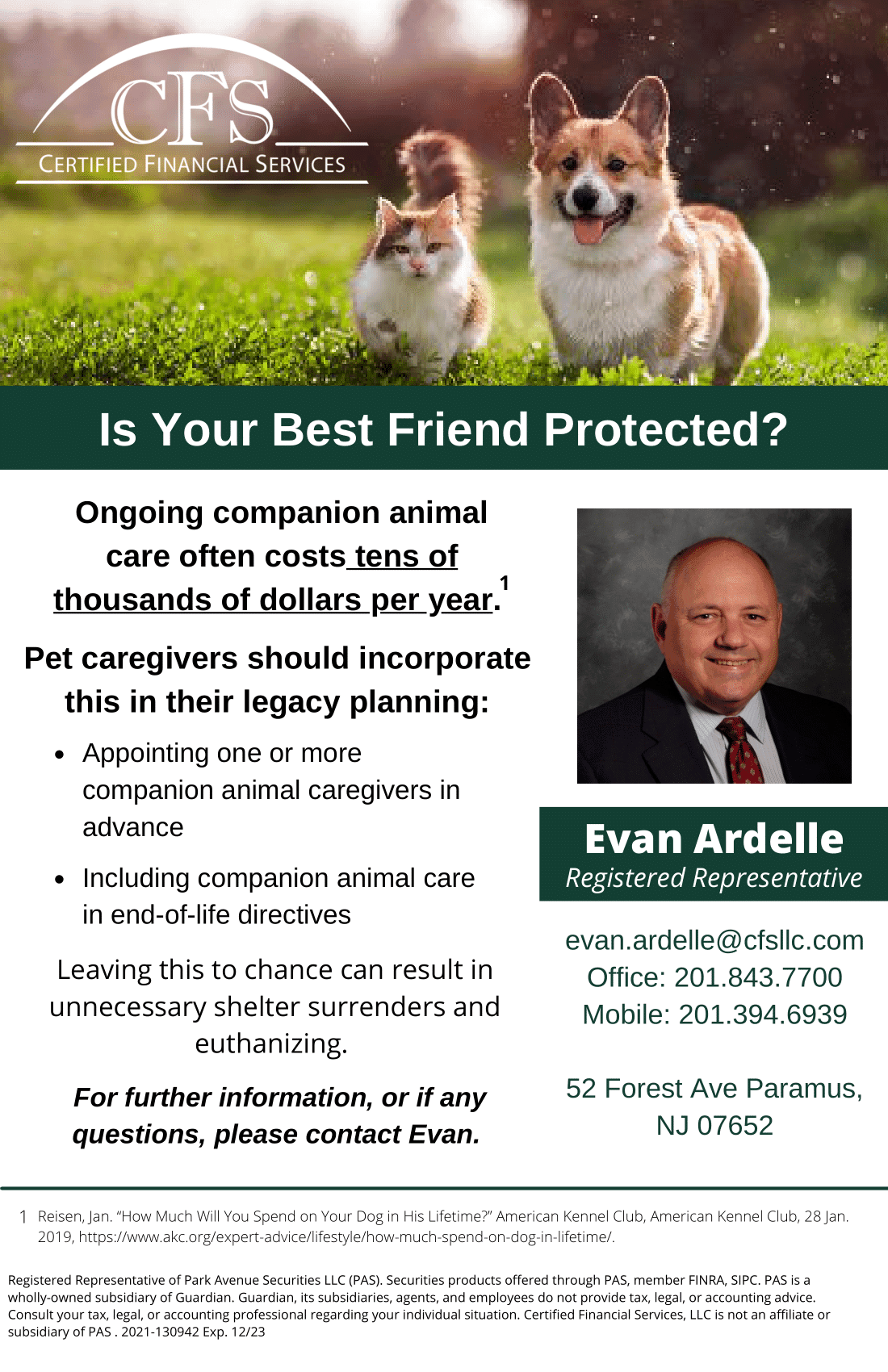

**The material presented in this website is intended as general educational information on the topics discussed herein and should not be interpreted as legal, financial or tax advice. Please seek the specific advice of your tax advisor, attorney, and/or financial planner to discuss the application of these topics to your individual situation.

Extending Your Legacy: Donating Your Pacemaker to Save a Dog's Life

Dogs, like humans, can suffer from heart conditions requiring pacemaker implants. These devices can significantly improve their quality of life and longevity. However, the cost of a new pacemaker can be prohibitive for many pet owners. By donating your pacemaker, you provide a life-saving solution to a dog in need.